|

|

|

|

Illiquidity and the danger it fosters for World Equity markets©

I trade daily. I traded Over-the-Counter options in the 60’s. I’ve been trading U.S. Stock Index Futures since the day they started in 1982. I was there in October 1987 when we experienced the 500 point single day decline known as Black Monday. In fact, I predicted that it would happen. Black Monday was our first memorable flash crash since 1929 but it would not be our last. I was in Asia in 1997 when both currency markets and equity markets took their dramatic fall. I saw first hand what it did to society! I traded the open after 9/11.

Then, in May of 2010 we experienced the debacle of a 1000 point decline in a matter of hours. Since that event, we have had numerous flash crashes in a variety of stocks. Regulatory agencies have spent months trying to figure out what went wrong. Countless interviews with endless numbers of experts pouring over reams of trade data continue to this day with little definitive to show for it.

None of this market activity however, is a surprise to those who understand markets from the bottom up. I’m talking about the mechanics of the markets, the nuts and bolts of market activity… The bid, the ask, and the size. All of these crashes have one common cause and that cause is illiquidity.

The problem today, whether it is the USA, China, or Europe is that regulators, who don’t understand market action, make the situation worse either by inappropriate regulation or inadequate regulation where regulation is dearly needed. Liquidity is the problem and wide market participation is the answer.

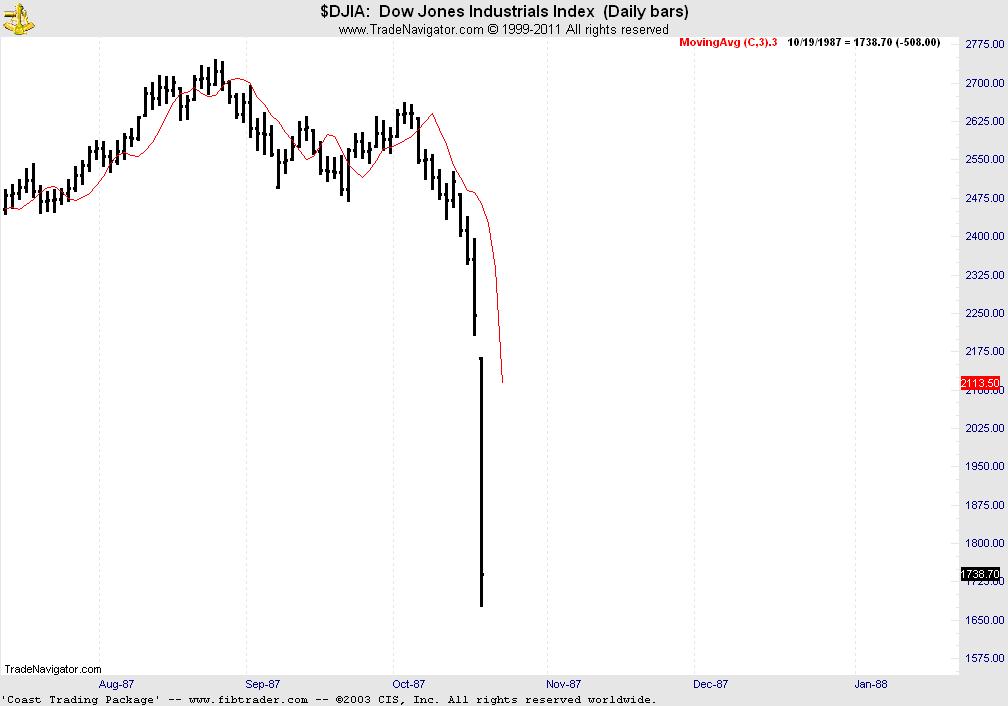

It was my observation of illiquidity occurring in the S&P futures pit in mid September of 1986 that allowed me to forecast the 500 point single day break that happened in October of 1987. It was the lack of liquidity in a variety of Asian markets that brought those markets to their knees in 1997, due in part to the absence of legal short selling. It was, without doubt, the illiquid conditions, apparent from late 2008 that caused the meltdown known as the flash crash in May of 2010. Blatantly unfair market conditions exist with the onset of high frequency trading computers and the total lack of accountability in our current market structure. Is it any wonder that liquidity providing humans are staying away.

These conditions persist and more crushing and debilitating market days will come as sure as night follows day. The emerging markets may be at even more risk than those of more mature status as contagion can spread across the world in micro seconds.

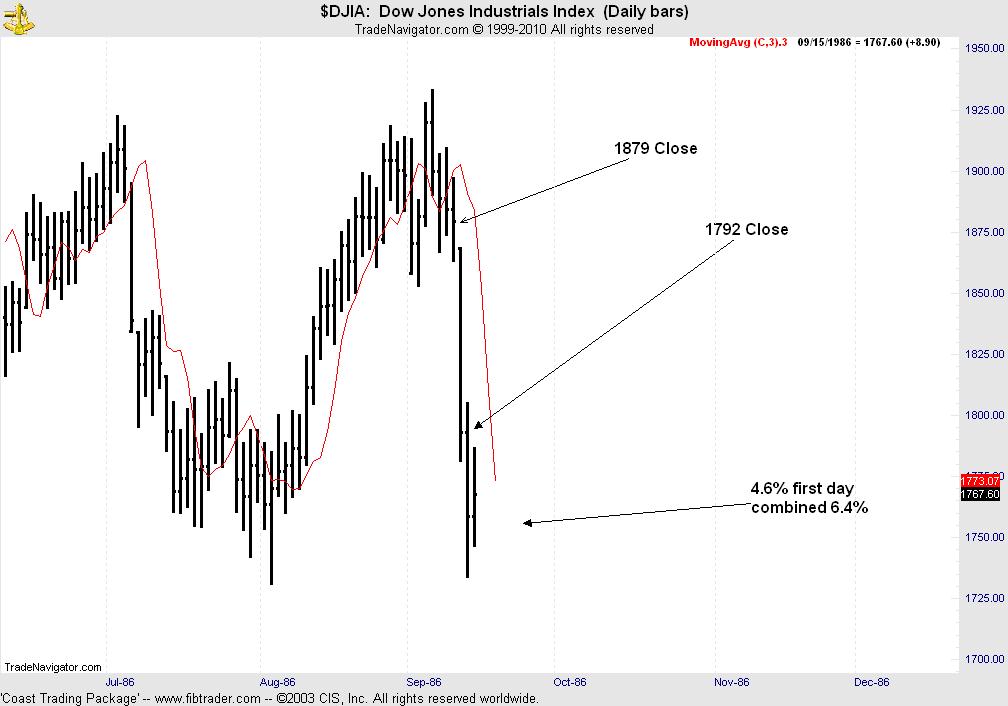

Let’s revisit 1986 where it became apparent to this trader that there would be a single day 500point Dow decline. On the day pictured below, September 1986, the Dow suffered one of its biggest one day losses to that point in time.

What is not shown and what needs to be experienced to be appreciated was the trading in the S&P pit on the day in question. There was a complete dearth of bids in the market. Sellers were not filled at any reasonable levels and buyers were killed on the spot. It gave the term “trade execution” a whole new meaning. This was the day the S&P locals (pit traders) learned to keep their hands in their pockets. One of the causes of this dramatic decline was the size of the S&P contract. In 1986 there were no eminis and the contract could put even a well healed floor trader directly in front of an oncoming bus on South Wacker Drive, if he were not careful. The public, although permitted to trade on fairly low margin requirements, had already learned that this thing was just too big to handle. Therefore, after this day in 1986, there was significantly less participation on big down days resulting in classic illiquidity. When you trade for a living, you learn how to survive or you’re gone. Black Monday, the 500point single day DOW decline, was simply waiting to happen. The chart below shows the day that it did!

Today we can look eastward to the China Stock Index Futures contract to see the similarities between its size and the size of the S&P contract back in 1986. Except in China the situation is worse. In a sincere effort to paternally protect its citizens against the effects of margin, the regulatory bodies have set the bar so high the average trader has no hope of participating. The result is illiquidity.

Before I go further, I realize that some of you might confuse volume with liquidity. This is a fatal error. One can have little to do with the other. For accurate statistical averaging or real price discovery, wide participation by a wide variety of traders with vastly differing motivations is necessary. Consider two hedge funds trading a billion shares back and forth between one another. Lots of volume, no liquidity. This situation is not the same as a billion traders trading 2 shares back and forth between each other. Huge liquidity. Now let’s consider the so called high frequency traders who skim riskless profits from the rest of us in billions of dollars. They now account for approximately 60% of volume in the US equity markets and by their actions decrease liquidity as more and more traders learn just how unfair their practices truly are and simply stay away. I can see my own trading volume decrease by almost 75% since late 2008. Like Sun Tzu councils “Avoid battles you cannot win”.

Markets have internal structures, the nature of which goes beyond the scope of this article. When great masses of people trade relatively small quantities of stock, the structure is maintained in a healthy way. Liquidity providers on smaller time frames are amply rewarded. When large market operators trade huge numbers of shares between each other to attract attention to an equity, structure is undermined because this activity is not representative of true price discovery. This is by the way an illegal practice. It used to be called “Painting The Tape” but few care about illegalities today in this anything goes financial arena. After all, no one goes to jail anymore except the most high profile and obvious crooks on Wall Street and around the world. I’ll come back to this critical point a bit later since it is a major cause of today’s illiquid market environment

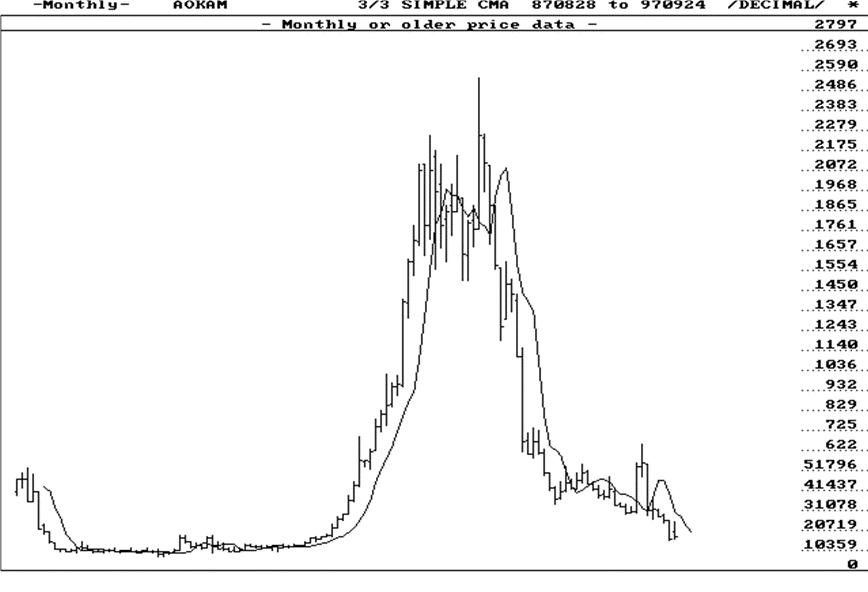

Below is pictured a popular stock on the KLSE in 1997. This is one of hundreds across the region that behaved in the same way.

The dramatic fall and total lack of buying on the way down can be attributed at least in part to well meaning but misguided government policies in the region that prohibit legal short selling. Legal short selling is a stabilizing influence on overheated markets on the way up and crashing markets on the way down. After all, for a short seller to make a profit he must buy on the way down. Legal Short selling however is not to be confused with fraudulent short selling, or so called “naked short selling” which is another clearly illegal practice. Some large firms that participate in this damaging and illegal activity, care only about their bonuses and care nothing about the havoc to companies and the families these companies support. They make hundreds of millions committing this crime and since there is no effective enforcement it continues. This practice continues to distort market pricing and provide a few large firms with an advantage over the rest of us. Regulators where are you?? You have the records, throw this scum in jail where they belong and restore some trust and thereby liquidity.

Before we look at the Flash crash, let’s look at some of the sources of illiquidity that are present in our markets today:

1 - The correct assumption that the markets are not properly regulated and are unfair to the smaller trader and even many institutional traders that are not participating in outright fraud or activities brought about by lack of prudent oversight.

2 - A significant reduction in the number of traders both professional and private due to the economic crisis of the past two years

3 - High frequency traders who front run orders using sub penny pricing and fraudulent denial of service trading techniques.

4 - Computerized trading that takes near riskless profits out of markets by exploiting time differentials in micro-second intervals in various markets, thereby raising the costs for all other traders

5 - Fraudulent Short selling where it takes only money, greed and avarice, to destroy a thriving business.

6 - Markets that are no longer free to trade normally because of government policies like money printing on a gargantuan scale

Let’s take a look at just one of these issues, so you can better understand why such practices force traders to stop trading and thereby reduce market liquidity, “Sub penny pricing”.

During the flash crash a professional trader for a respected firm placed an order to buy Morgan Stanley at 13. There were no bids whatsoever in the market, only an offer at 20. Instantly a bid front runs his bid at 13.001… So he raises his order to 14 and again instantly a bid at 14.001 comes into the market. What is happening is that his order is being front run by a sub penny (likely a hi frequency trading computer) and the only way he will get a fill is if the sub penny front runner is hit and decides the market is against him. Then and only then will the sub penny, illiquidity creating computer, stuff the order to the original 14 bid. He will do this before the bid at 14 can be cancelled. The net effect of this game is that the original bidder will only get a fill if he is wrong the market. It is a heads you win tales I lose situation. Is it any wonder liquidity providing traders are staying away.

Practices like these are not being policed by the regulatory agencies. Sanctioned theft is supported by the lobbyist bribes in Washington DC. Lawmakers apparently do not know or do not care that voracious and unbridled parasitic forces are draining the life out of our capital markets. It is likely nothing will be done until we experience something worse than the flash crash pictured below which took one day to wipe out months of gains.

Again, this is a break caused by illiquidity where a large market player can simply press a market to the point where bids are absorbed and force carnage. This would not be possible in a normal market but today’s poorly regulated environment is ripe for this type of action.

Let’s look at the conditions I have described and see if the Chinese markets could be subject to the same issues.

1-Short selling is not widely allowed.

2-Contract size of China Stock Index Futures contract is very large.

3-Current regulations prevent many traders from participating.

4- Regulations also prevent certain other foreign entities from directly trading Chinese shares.

5- Already we regularly see moves in the Chinese markets in excess of 4%.

Fortunately up to this point, it seems the majority of traders feel the Chinese market is fair. If this feeling changes however, as it has in many parts of the world, we could easily see the same effects in China that we see elsewhere.

Chinese and other Asian regulatory bodies however seem to have their motivations properly centered at providing stable and well trusted Capital market structures, rather than sucking up to the latest campaign contribution. If they can learn from the mistakes made by US financial markets regulators and lawmakers and adjust their policies accordingly, Chinese Capital markets will develop even faster and healthier in the future than they have to date. This is a tall order but not unrealistic if the people in charge get the necessary expertise from real traders who understand the problem. Then, conscientious regulators and lawmakers need to act on the information, not just conduct endless hearings while what is left of Rome continues to burn.

|

|

|

Seminar

Seminar  Software

Software  Subscriptions

Subscriptions

Seminar

Seminar  Software

Software  Subscriptions

Subscriptions